记载过的Problem solver讲座后,对waterloo concept产生了小迷妹憧憬,以后可能还有讲座笔记.

这次是个人理财.

图书推荐,关于behavioural finance:Psychology of money

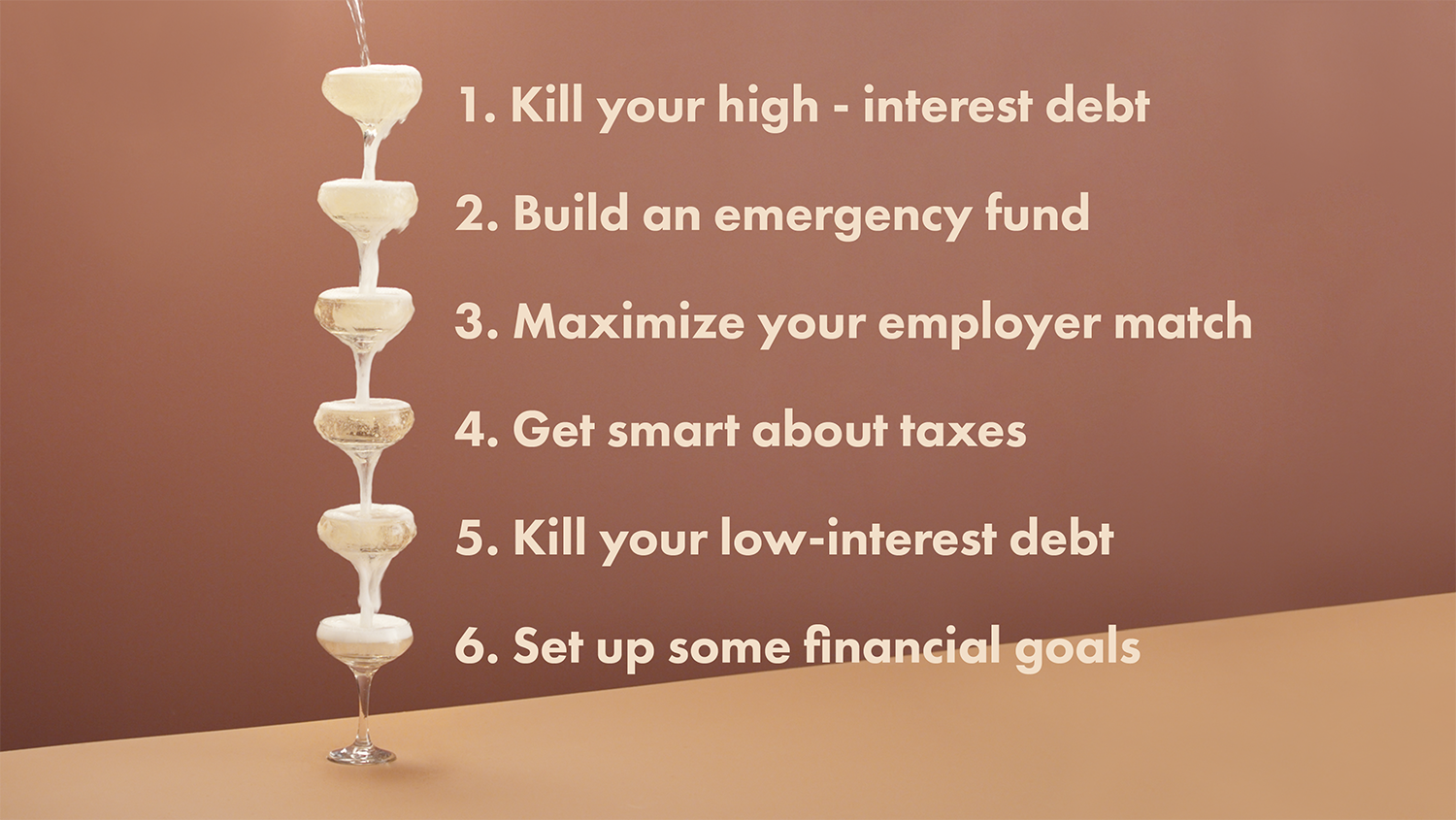

Financial tips I wish I knew early in life :-)

- Know how credit card works

- Open an TFSA(Tax-Free Savings Account)

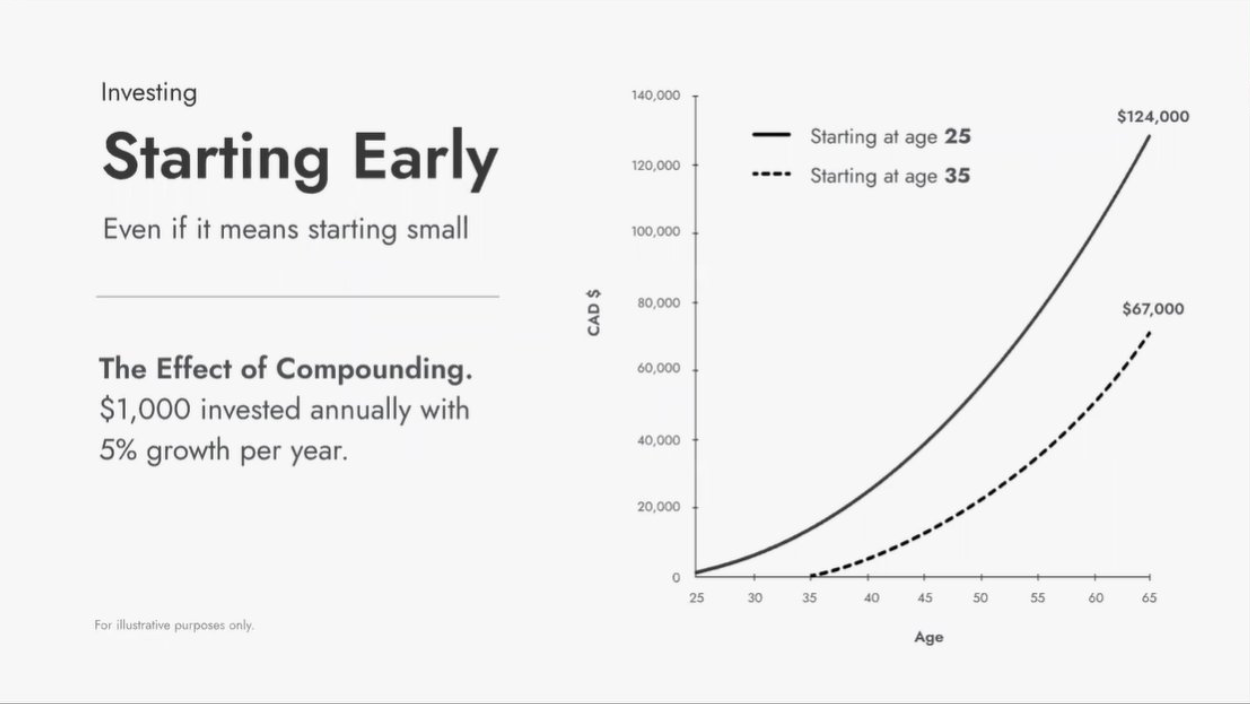

- Start to invest early

- Don’t having your money all in chequing account

Emergency fund:比如说三个月的生活费.

Employer matching:

Employer matching of your 401(k) contributions means that your employer contributes a certain amount to your retirement savings plan based on the amount of your annual contribution.

Compensation(赔偿) package:

Summaries of the methods employers use to pay their employees and the amounts they provide.

插入吐槽之:

聊到Financial goals的时候,大部分人都说买车买房,少数有travel的愿望,再再少数还有位说child education, tuition fee(further education), early retirement,最后是financial freedom.

感叹买车买房算人生共有的一个boss关卡.

how to budget

讲座小姐姐用的记账appmint.

我曾用过一个~纸片人老婆和你一起记账~的app,还挺好玩的说实话.

Fixed Expenses

The bills you must pay each month(whether you like it or not).Meaningful Savings

$ that is aside to improve your net worth by increasing savings or decreasing debt.Short-term Savings

The emergency stash.Spending Money

The left over!

how much to save

How much should I save?

Any amount! Start small if it helps you start sooner.

Should I save in cash?

Your emergency fund should be in cash or if you need to make a large purchase in under 3 years.

Where should I invest long term savings?

In tax advantaged accounts like TFSAs or RRSPs.

关于每个月应该拿出多少收入来存款.小姐姐讲她自己是把收入的10%作为存款.

通行的小哥补充说有一个rule叫做30/30/40.

40% for statistic expense, 30% for flexible and personal spending, 30% for saving, but also depending on your situation.

where to invest

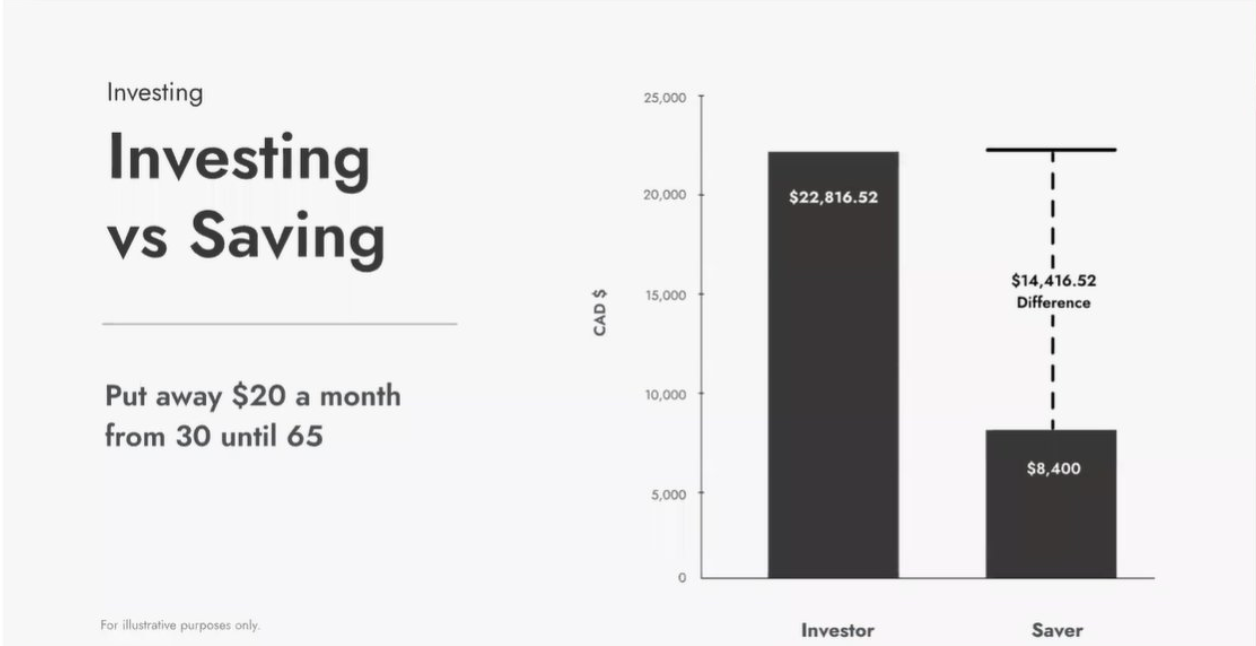

真是让人有动力的对比图呢.

在加拿大常见投资账号: